Competitor-aware buying and pricing intelligence for dealer groups.

Weekly strategy and daily repricing decisions powered by true like-for-like comparables—without spreadsheets.

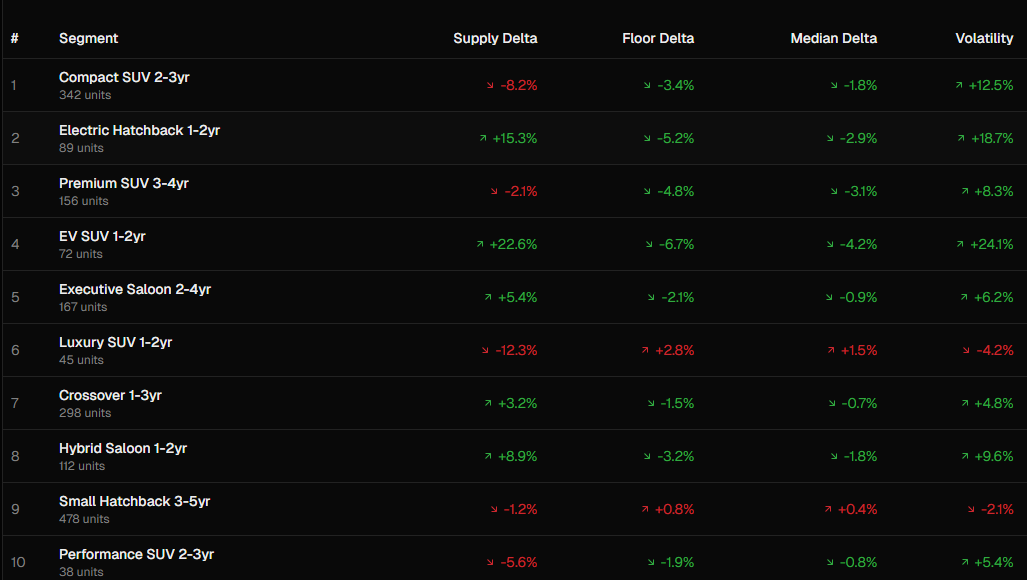

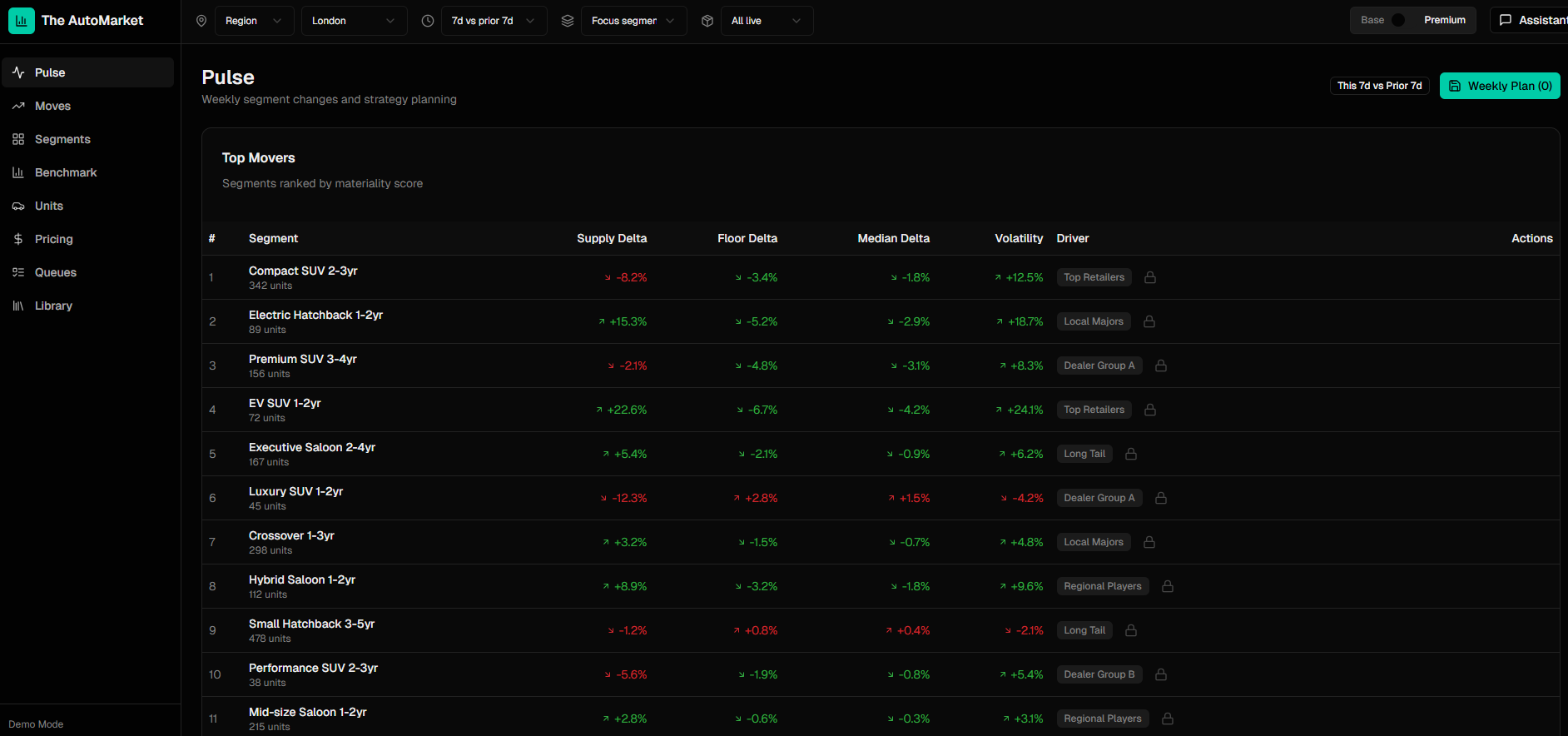

- Weekly pulse: what changed by segment and why.

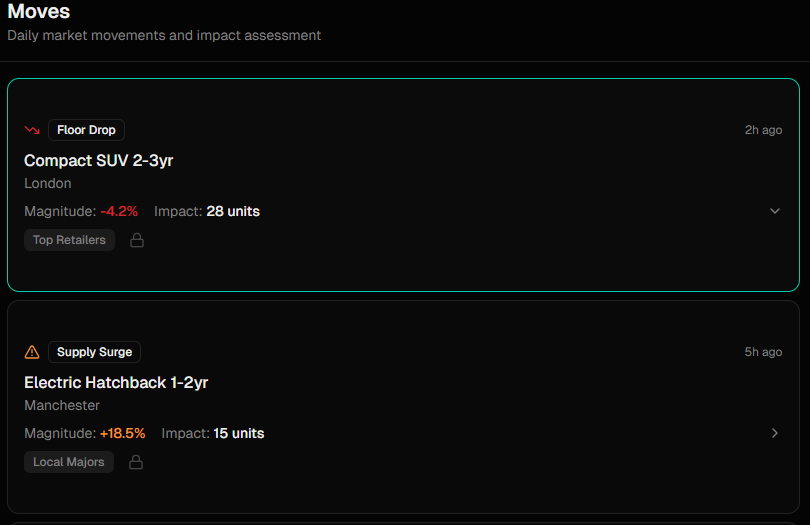

- Moves feed: market shifts → impacted stock queue.

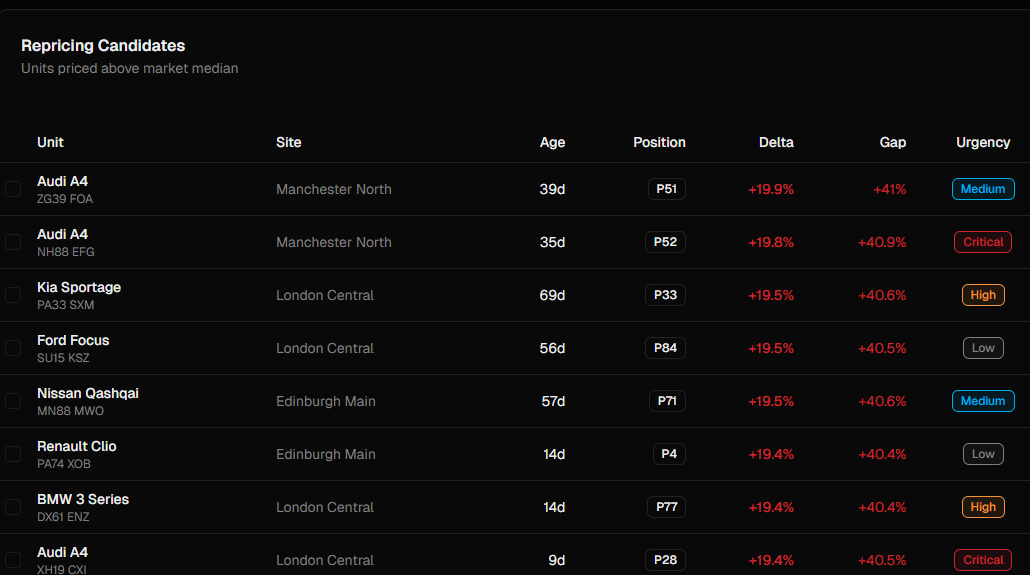

- Pricing triage: ranked reprices → exportable queue.

- Unit check: buy ceiling + retail band backed by evidence comparables.

The problem with current approaches

Without segment-level visibility, overstocking happens silently. You discover it when cars hit 60+ days.

Make/model/age isn't enough. Spec differences drive real price gaps that crude groupings hide.

By the time you notice a pricing shift, you've already lost margin or missed the window.

Four workflows, one intelligence layer

From weekly strategy to daily execution, every decision backed by real comparables.

What changed this week and why?

Weekly movers table + guardrails for buying plan.

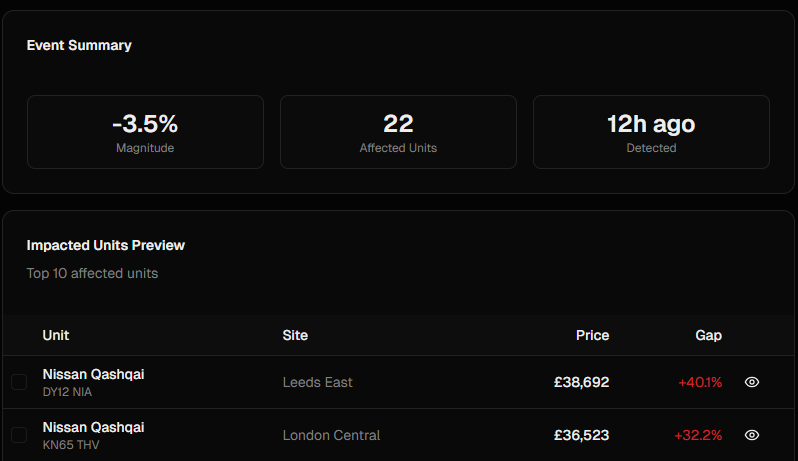

What market events affect my stock today?

Daily moves feed → impacted stock queue.

Which cars need repricing right now?

Ranked repricing candidates → exportable queue.

Should I buy this car at this price?

Buy ceiling + retail band + evidence comparables.

Real comparables, not crude buckets.

Every recommendation shows exactly which cars it compared against, with match quality indicators you can verify.

Spec-aware matching

Near-identical cars match as near-identical. Trim, mileage band, and equipment matter.

Evidence-first design

Every recommendation shows the comparable set. No black boxes.

Confidence signals

Match quality badges and freshness indicators so you know when to trust the signal.

Two tiers, one platform

Base shows cohorts; Premium reveals who. All workflows work in both tiers.

Full market intelligence with anonymous competitor effects

- Weekly pulse + daily moves

- Pricing triage + queues

- Unit check with evidence

- Cohort-level attribution

- All core workflows included

Named competitor attribution and benchmarking

- Everything in Base

- Named competitor attribution

- Competitor benchmarking scorecards

- Competitor watchlists + alerts

- Drill-down by competitor

Base shows cohort-level effects (e.g., "Large franchise groups"). Premium reveals named competitors.

How it works

Five steps from setup to action. Works alongside your sourcing partner—we don't source stock.

Set geo + segment scope

Define your market: regions, segments, and inventory focus.

Review weekly pulse and daily moves

See what changed and which events impact your stock.

Inspect evidence comparables

Verify recommendations against real comparable sets.

Create queues

Build impacted stock and repricing queues for action.

Export into existing workflow

CSV export or API integration with your systems.

Works alongside your sourcing partner. We provide intelligence, not inventory.

Built for your team

Different cadences, different questions—one platform.

Strategic focus across the group

Questions answered

- Which segments are moving against us?

- Where should we tighten or loosen guardrails?

- Which competitors are shifting strategy?

Buy validation at the unit level

Questions answered

- Should I buy this car at this price?

- What's the realistic retail band?

- Any risk flags I should know about?

Repricing triage and execution

Questions answered

- Which cars need repricing today?

- What's driving the price pressure?

- How do I prioritize the queue?

See your market in a week.

Demo uses sample data. Production onboarding is tailored to your group.